Bond ETF failure

A wakeup call for investors

Monday 13 March 2023 at 11:00:00 am AEDT 2 min readPlease click on any photo to view in a lightbox. Use arrow keys or swipe to navigate.

AGVT total return

AGVT total return  AGVT NAV

AGVT NAV A few days ago, I talked about the tendency for an ETF underperforming compared to holding the physical assets. I illustrated this through a simple model of a market consisting of two stocks and showed that the disparity between rebalancing frequency and index adjustment frequency can cause an ETF to make sub-optimal transactions that effectively lower NAV over time.

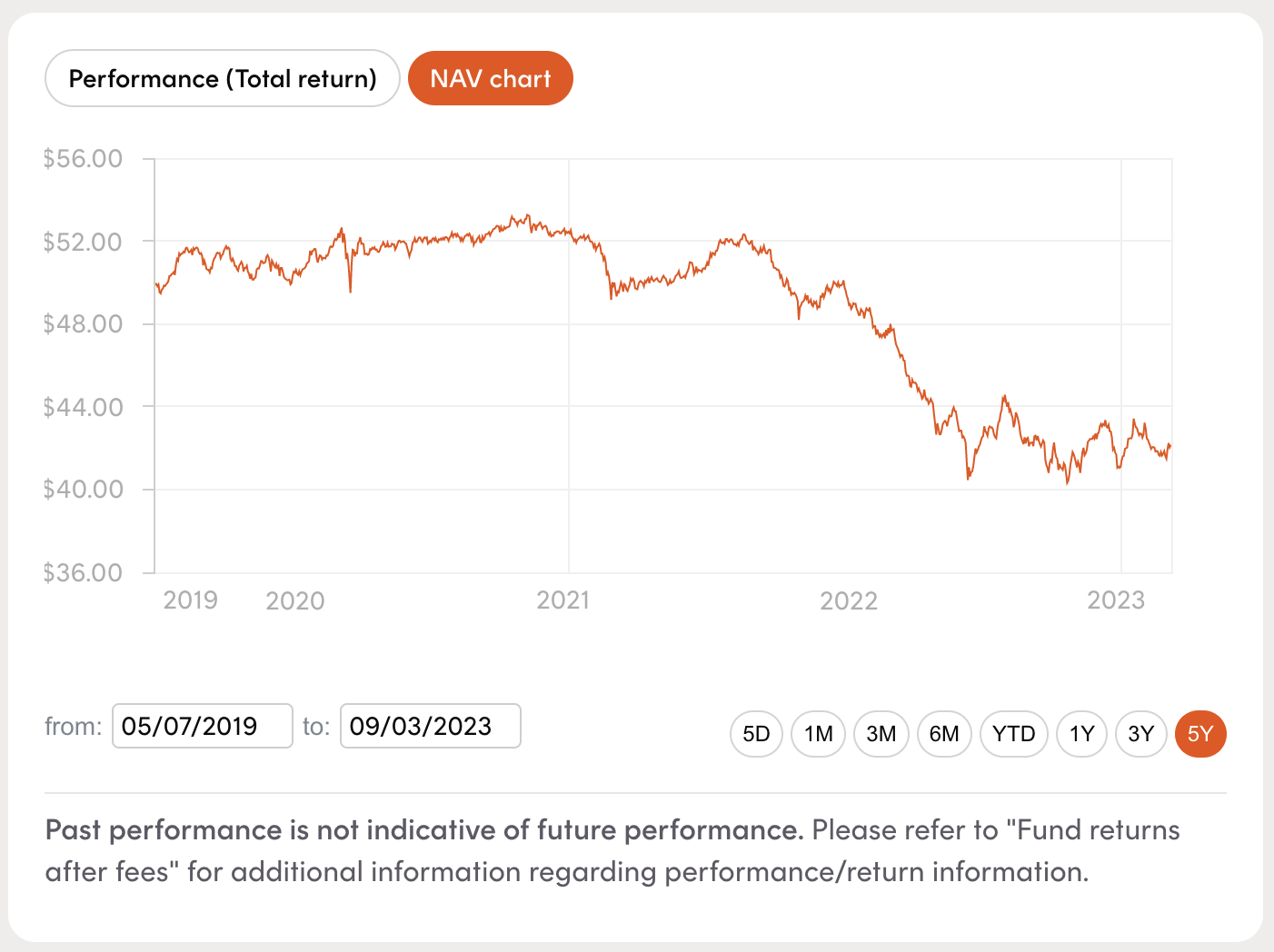

As an extreme example of this happening on a macro scale, consider the poor performance of bond ETFs over the last 5 years. I have attached two charts, screen captured from Betashares’ website, showing the NAV and total return of AGVT (Australian Government Bond ETF). By the way, I am not picking on Betashares, the performance of any bond ETF has been depressingly similar.

As can be seen, AGVT has had a total NEGATIVE return SINCE INCEPTION of -3.4% and the NAV has decreased 16%. Which means if you had bought this ETF since inception, you now have little prospect of recovering your capital, let alone earning a decent return. Effectively, this is a failed investment strategy.

According to Betashares, “AGVT aims to track the performance of an index (before fees and expenses) that provides exposure to a portfolio of high-quality bonds issued by Australian federal and state governments, and with a component issued by supranationals and sovereign agencies.”

So why are ETF holders not earning a steady income and a relatively stable NAV? It is an extreme example of my hypothesis of an ETF unwittingly executing a buy high sell low strategy.

In a period of declining interest rates, the ETF grew by purchasing bonds at issue price. When interest rates started rising in 2022, bond prices crashed and the ETF is forced to sell assets to fund redemptions. The lesson learnt here is that buying a bond ETF is not the same as investing in fixed income. The ETF is a quasi-equity security that delivers neither guaranteed income nor capital protection.

This has huge implications for investment strategies. Over the last few years, many investors have moved from “balanced funds” (that invest directly in physical assets) to holding a basket of ETFs, under the assumption that this was more flexible and has lower fees. We now see the dangers of over-reliance on ETFs and they may not deliver the investment outcomes that some may be expecting.